NarvalFi: The Unified Liquidity Layer for Next-Gen DeFi

A groundbreaking DeFi protocol designed to solve liquidity fragmentation and maximize capital efficiency. Built on Sui, it integrates lending, vaults, and DEX into a single, composable liquidity layer.

Key Protocol Innovations

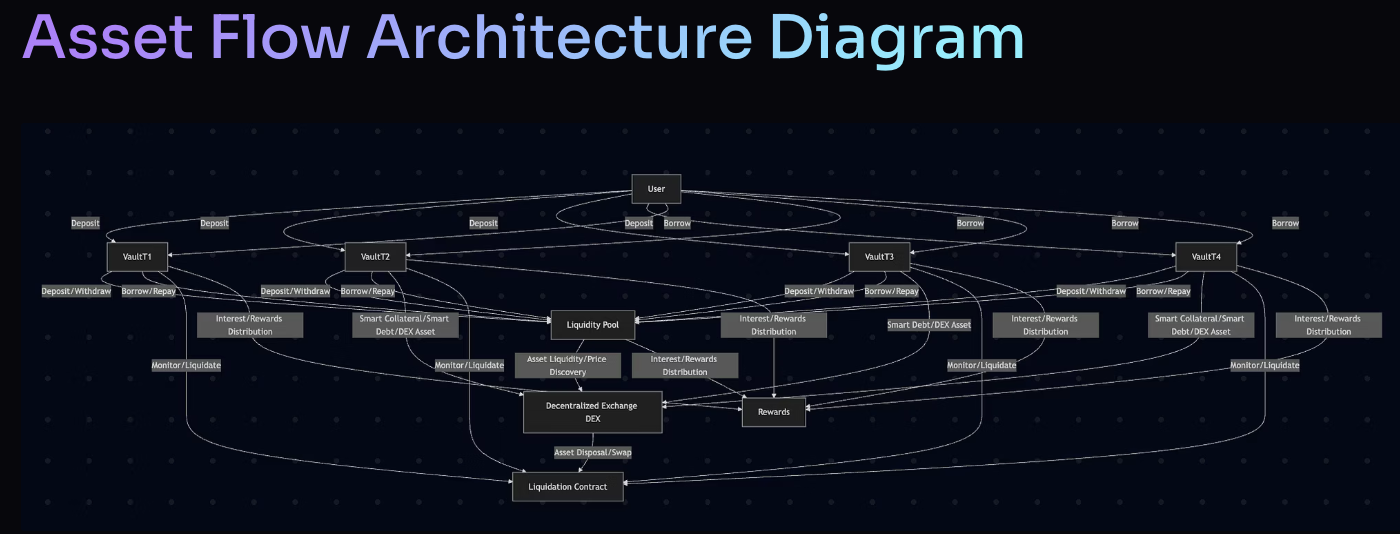

Unified Liquidity Layer

A central liquidity pool powering lending, vaults, and DEX. All protocols share the same liquidity, eliminating fragmentation and enabling seamless composability.

Smart Collateral & Smart Debt

Collateral and debt positions can simultaneously act as AMM liquidity, allowing users to earn trading fees.

Batch Liquidation Engine

Innovative batch/range liquidation inspired by Uniswap v3. Enables ultra-high LTV (up to 95%) and ultra-low penalty (as low as 0.1%), with gas-efficient, market-driven liquidations.

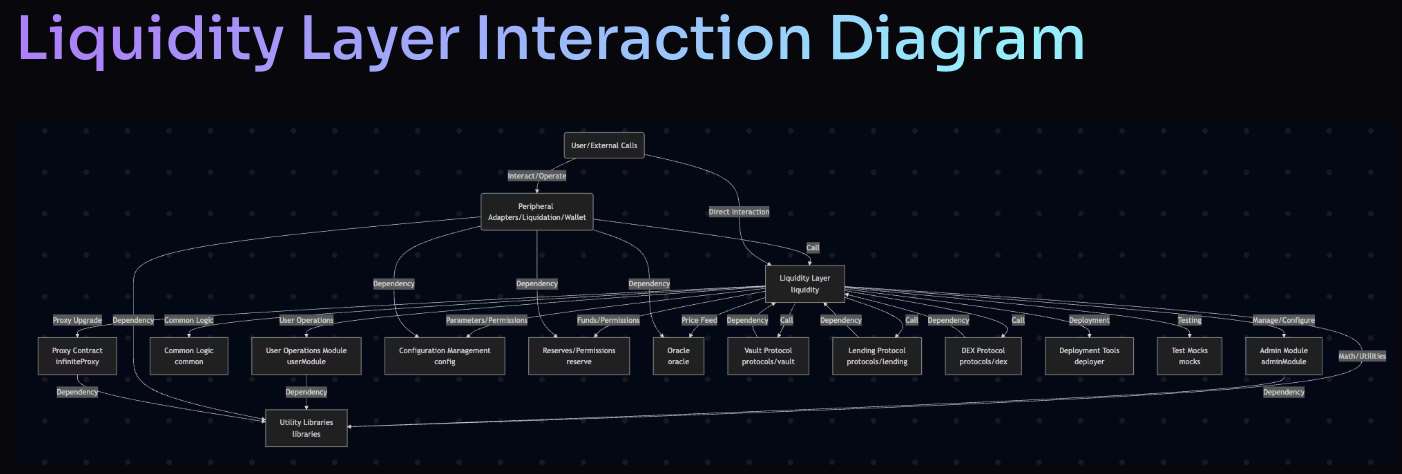

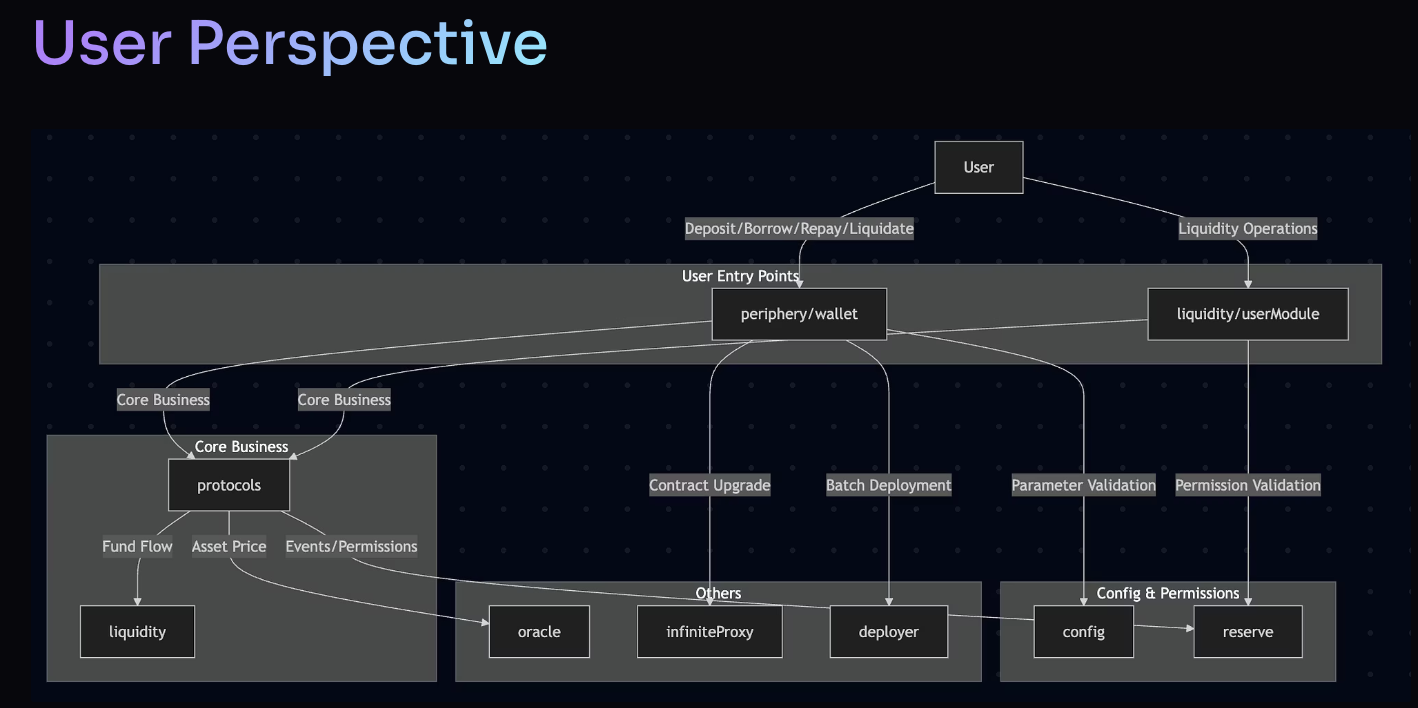

Modular & Secure Architecture

Separation of core liquidity and protocol logic, automated risk limits, robust oracle integration, and multi-layered security for a scalable, safe DeFi ecosystem.

Narval Protocol Architecture

Explore the core modules powering Narval: unified liquidity, advanced vaults, lending, DEX, smart collateral & debt, and a next-gen liquidation engine.

Lending Protocol

Standardized yield-bearing tokens that represent your share in the lending protocol.

Hybrid AMM, concentrated liquidity, allows collateral and debt to act as DEX liquidity, gas efficient, dynamic fees.

Smart Collateral & Smart Debt

Maximize leverage effective liquidity with our innovative DeFi solution.

Collateral and debt can act as DEX LP, earning trading fees while maximizing your leverage. This innovative approach enables up to 39x effective liquidity compared to traditional DeFi protocols, giving you more capital efficiency and higher potential returns.

Liquidation Engine

Advanced liquidation mechanism inspired by Uniswap technology

Our liquidation engine features batch/range liquidation capabilities, allowing for ultra-high LTV ratios with ultra-low penalties. The system is gas efficient and entirely market-driven, ensuring optimal performance even during high volatility periods.

Unparalleled Capital Efficiency

NarvalFi’s innovative architecture allows for up to liquidity through its Smart Collateral and Smart Debt mechanisms. Users can simultaneously provide liquidity, earn trading fees, and leverage their positions.

- →Up to 95% LTV with ultra-low liquidation penalties

- →Earn trading fees while using assets as collateral

- →Composable liquidity across lending, vaults, and DEX